-

What are you looking for?

Common Searches

As financial crime becomes more frequent, complex, and costly, proactive fraud prevention is critical to maintaining trust and protecting long-term value.

Ultradata’s fraud prevention solutions provide always-on protection against unauthorised access to financial institutions’ systems, safeguarding funds and customer data.

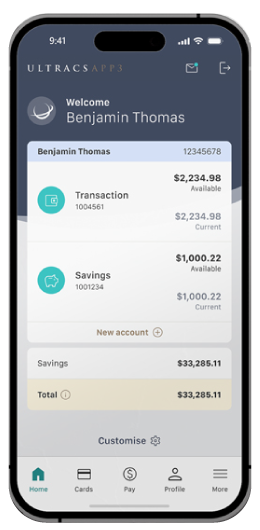

Fully integrated across the Ultracs Ecosystem, our solutions equip fraud prevention teams with the tools to efficiently prevent fraud at scale and stay ahead of emerging cybersecurity threats.

Fraud Interceptor is an end-to-end financial fraud prevention software solution that provides real-time fraud detection across all channels. By monitoring every transaction that passes through the Ultracs core banking system, it gives financial institutions’ fraud teams unparalleled visibility.

Biometric ID verification offers a robust, encrypted and secure customer authentication solution for the digital customer onboarding process. When enabled, it provides optimal protection against document-based identity fraud, with minimal impact on customers.

The solution screens against sanction lists, provides QR code functionality to seamlessly transfer desktop users to their mobile for a live selfie capture, and supports the instant verification of Australian IDs. Though this unified process, financial institutions can provide an advanced, no-touch onboarding solution while maintaining the highest Know Your Customer (KYC) standards.

Ultradata’s client authentication solution empowers financial institutions to securely verify customer identities at any touchpoint, preventing fraud while streamlining customer service. Fully customisable to meet any workflow, it delivers a user-friendly interface for staff and ensures consistent Know Your Customer (KYC) compliance across all channels.

The solution can be deployed as a user-friendly addition to the Ultracs Core Banking System or with Ultracs Cloud. To further consolidate this simple, yet central, customer service touchpoint, User Authentication and Verification can be integrated to work with a financial institution's phone system.