Ground Floor, 1919 Malvern Road,

Malvern East,

VIC 3145 Australia.

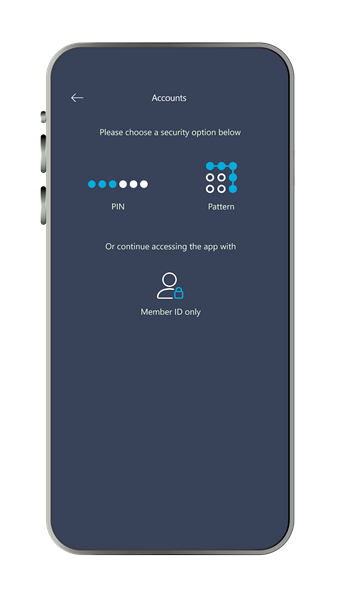

New and existing customers can self-service their ability to set, change and reset passwords without delay, reducing calls to your operators and minimising the associated operational costs.

Issuance of a digital card may be integrated as part of an onboarding / account registration process so that customers can start transacting immediately and no longer need to wait for a physical card to arrive in the mail.

Digital cards can be used immediately for;

online purchases; and

customers can also instantly provision the card to their digital wallet to transact in-store and perform ‘tap and go’ purchases using their mobile device.

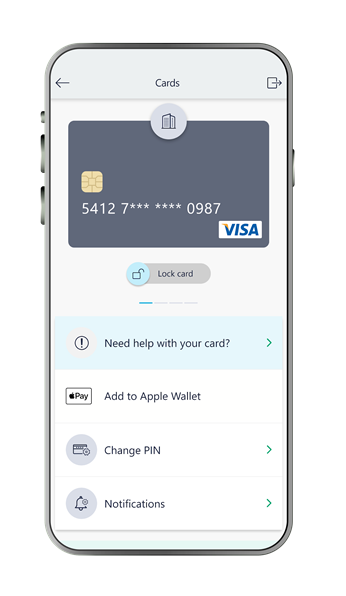

Digital cards have the same characteristics as a plastic card including a PAN, expiry date, CVV2 number, and PIN. If a digital card is offered together with a plastic card, they will both share the same card details PAN, expiry date, and CVV2 number.

The digital card issuance requires functionality from each switch provider. In the first instance, this has been built for Cuscal clients only.

Digital card issuance requires the operation of our ‘Digital card controls’ software module below to allow customers to control additional risks associated with digital card issuance.

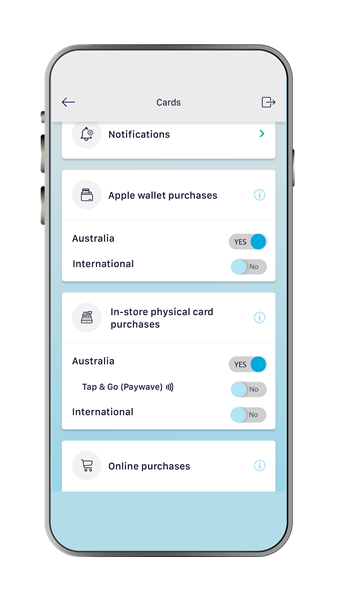

The digital card controls module facilitates self-service transaction controls on purchases and empowers customers with stronger control their cards, both plastic and digital, through an extended range of card controls.

New card controls allow customers to manage and turn on/turn off domestic and/or international purchases for;

These will be added to existing card controls for:

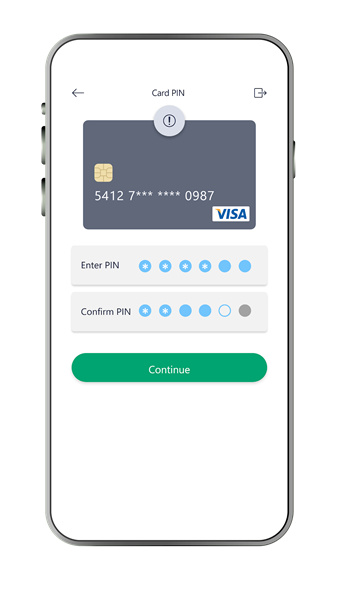

To get your customer transacting immediately with your financial institution, and to firm up their loyalty, it is desirable for customers to have the ability to set a PIN for their digital card at the time of onboarding.

Set PIN for digital cards gives customers this ability allowing them to choose a PIN to apply to their digital card upon completing their onboarding and App registration process. Customers do not need to wait for the delivery of the PIN via PIN mailer before they can start transacting.

Other benefits of issuing the PIN within the onboarding process include reducing security risks of a PIN being mailed and immediate access for customers who are travelling.

Set digital card PIN functionality will also work for digital card reissue and customers will be asked to choose a PIN to apply to their digital card if they cancel or reorder an existing digital card.

The One-Time Password module may be integrated for added security.

Open Banking data sharing dashboard

Open Banking data sharing dashboardThe Open Banking data sharing dashboard delivers on the Australian Consumer Data Right compliance regulations, and allows customers to explore new market opportunities and manage sharing of their financial data with other financial institutions.

Ultracs App 2 latest release provides customers with the ability to authorise and manage the sharing of their financial data held by their financial institution with accredited third parties.

A data sharing dashboard in the App allows customers to;

Access to the dashboard is securely facilitated through the use of the ‘Ultracs authentication for Ultracs forms and Open Banking data sharing dashboard’ functionality for seamless and secure journeys to and from the dashboard within the App.

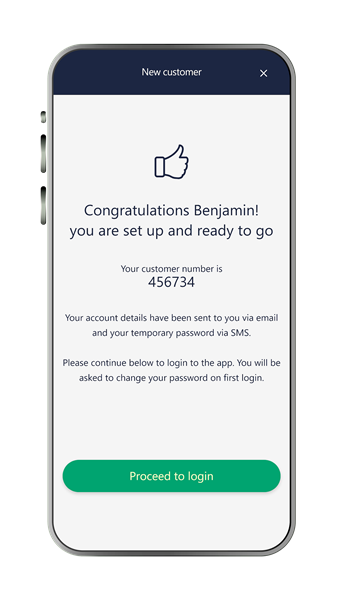

Onboarding and account opening within Ultracs App 2 latest release can be facilitated by embedding within the App an onboarding and account opening workflow built using Ultracs Forms.

This is designed and embedded in such a way that the user experience is seamless so that when the user proceeds from Ultracs App 2 screens to Ultracs Forms screens, and back to the App screen, the user does not realise they are using separate systems.

In one seamless process new customers are guided through the following steps in minutes;

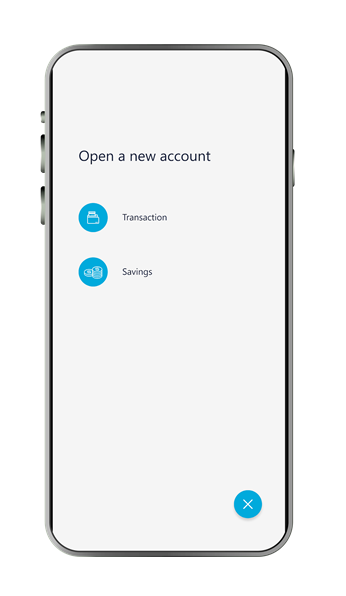

Account opening can be embedded within the App to support cross-selling and simple account opening workflow so that existing customers can open accounts direct from within the App without having to do so via another channels such as the web or in a branch.

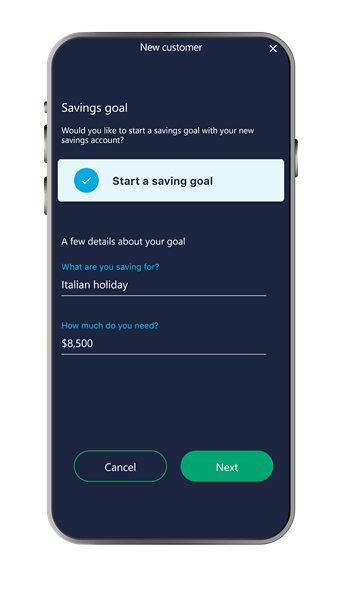

With the option to integrate the creation of a savings goal as part of the onboarding and account opening workflows, customers will have another personal finance management tool that gives them the ability to set a savings target and monitor their progress in achieving their target.

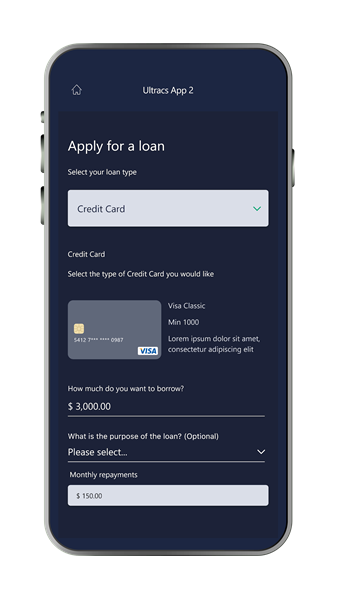

The Online Lending module can be embedded within Ultracs App 2 latest release to facilitate easy self-service loan or credit card application for customers through one simplified step-by-step process.

Online Lending is fully integrated with the Ultracs core banking system which drives the seamless process.

Call us and ask our Client Engagement team for a detailed Ultracs App 2 latest release product brochure, and unlock opportunities to engage with new and existing customers.