Ground Floor, 1919 Malvern Road,

Malvern East,

VIC 3145 Australia.

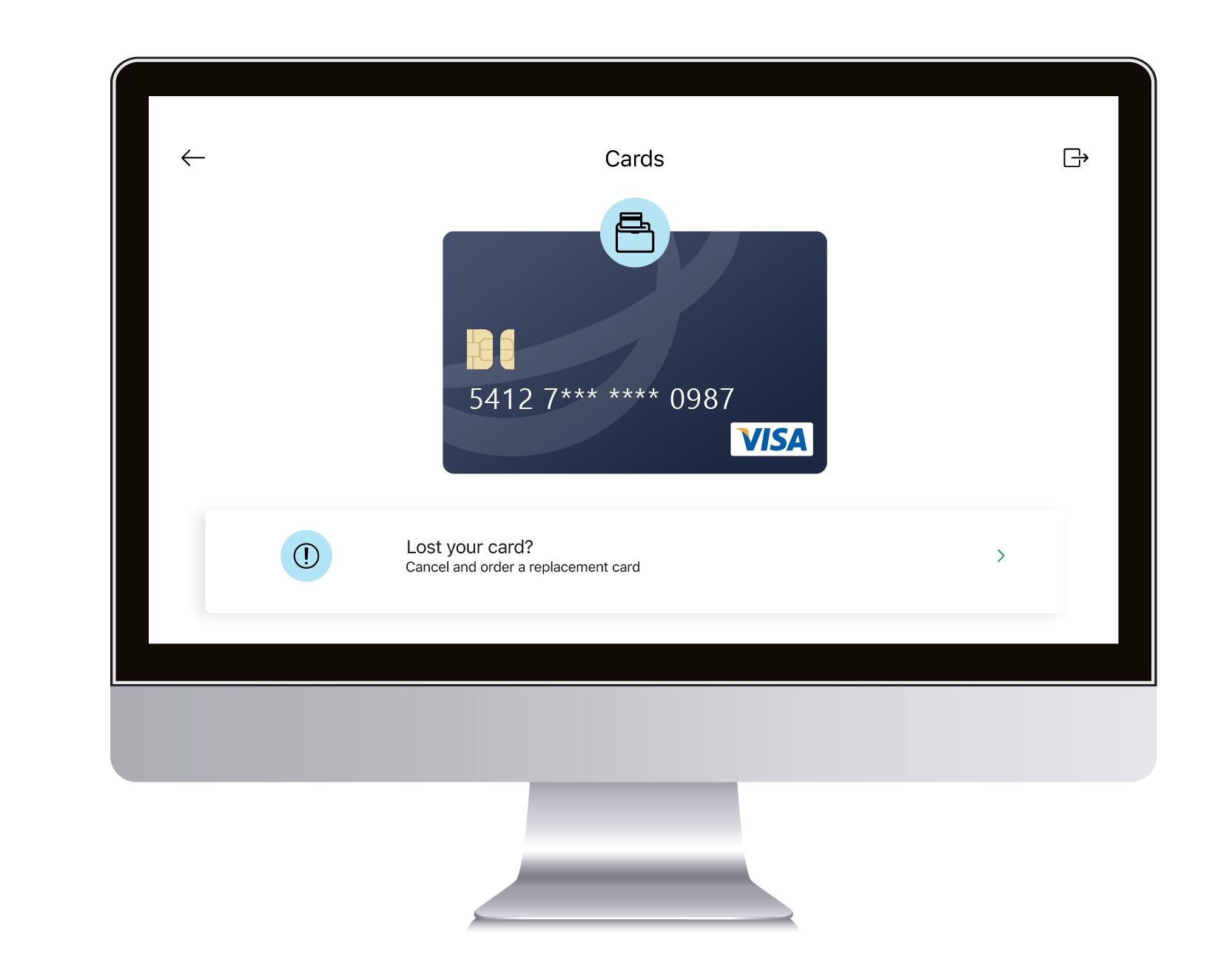

Self-service card management enables customers to conveniently view and manage their cards without any delays. It is instant banking.

The card management module also provides customers with the option to set card security precautions to take immediate effect in the event a card is lost, stolen or damaged.

Options include;

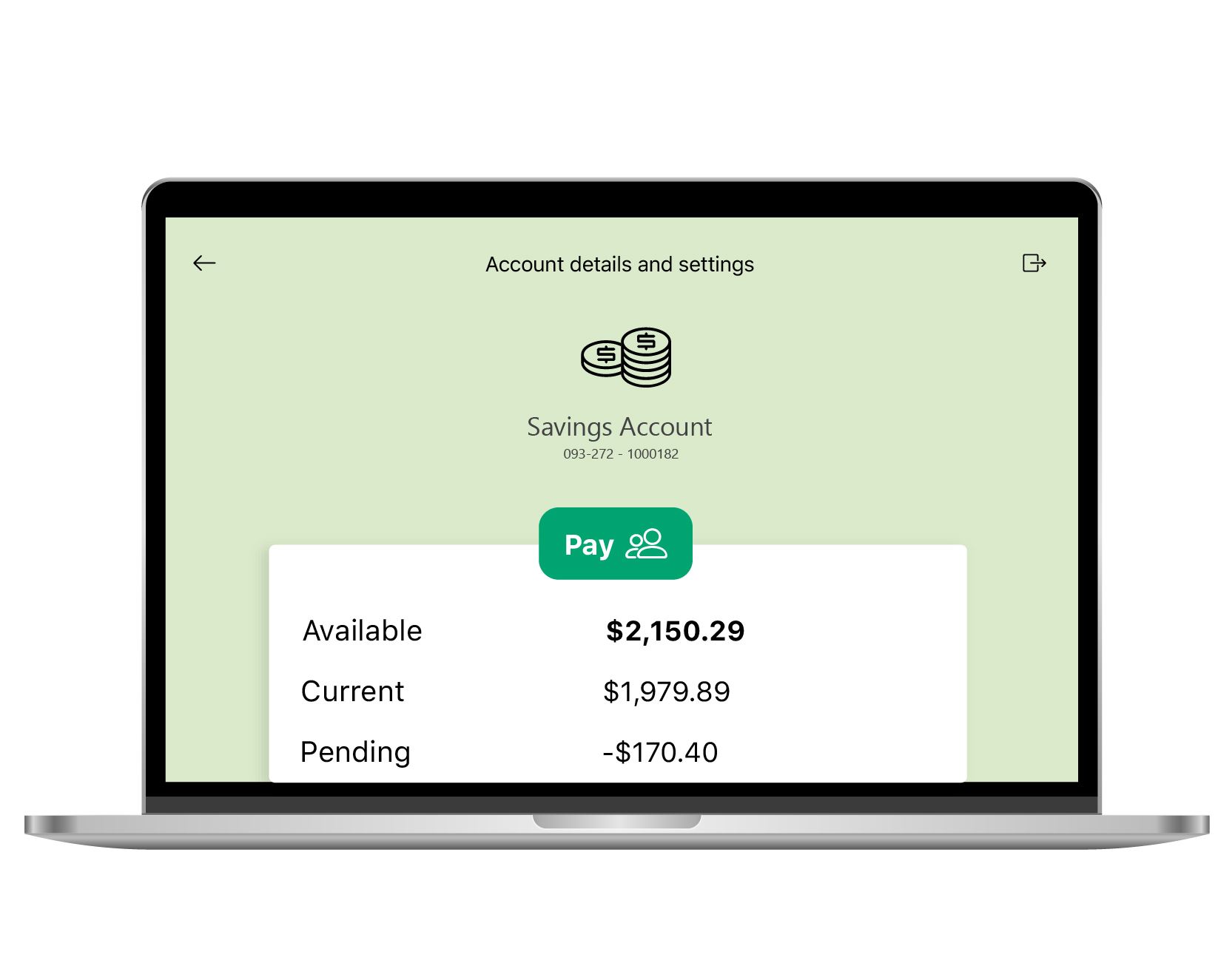

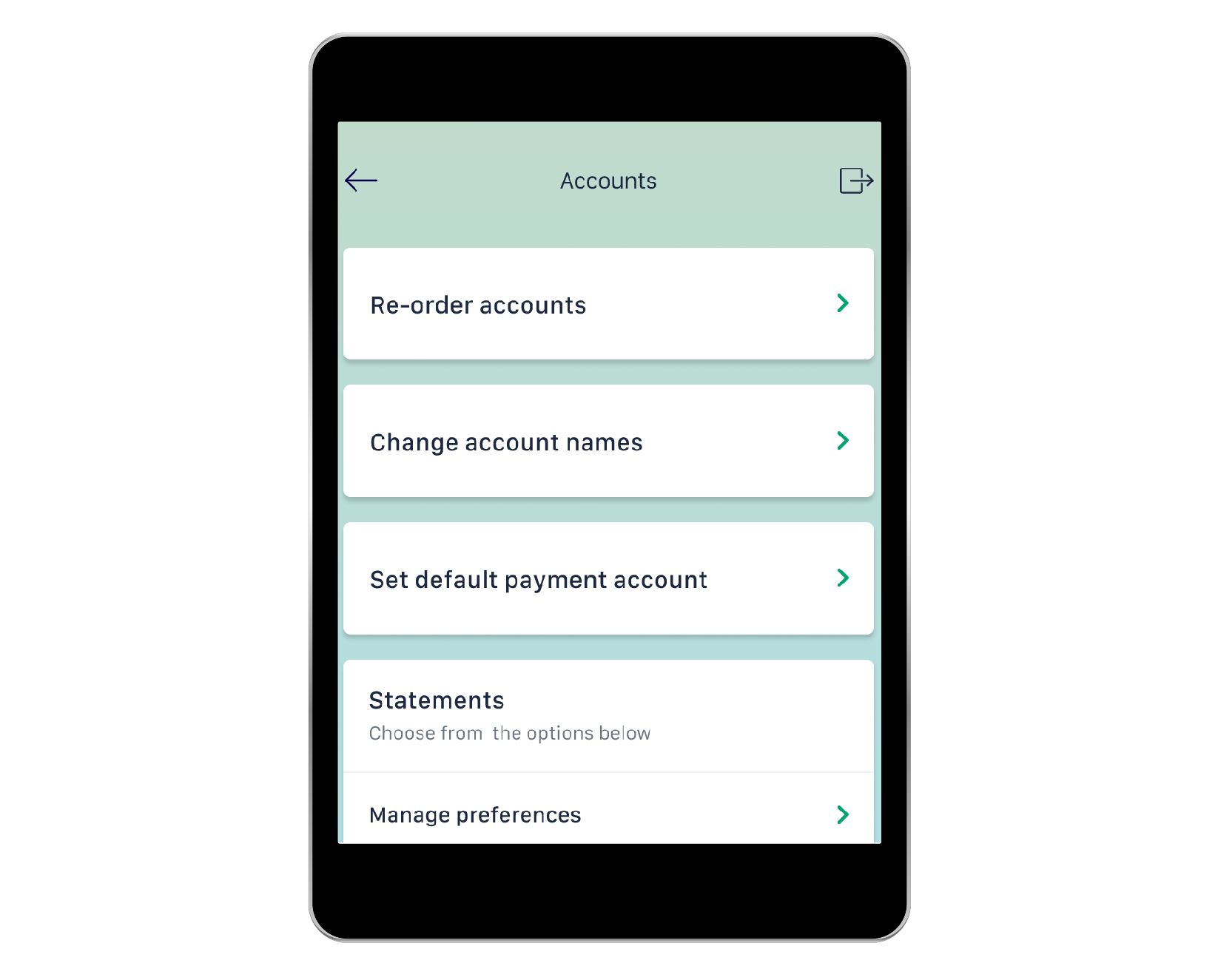

Account management, for customers that possess the right access and status, allows customers to change their account summary presentation and view accounts within groups ordered by their client number.

This view displays all of the accounts a customer has ownership or an operational relationship for in a more logical and user friendly sequence.

The latest statement frequency software solution offers customers with self-service capabilities to set their own preferred frequency and preferred distribution type.

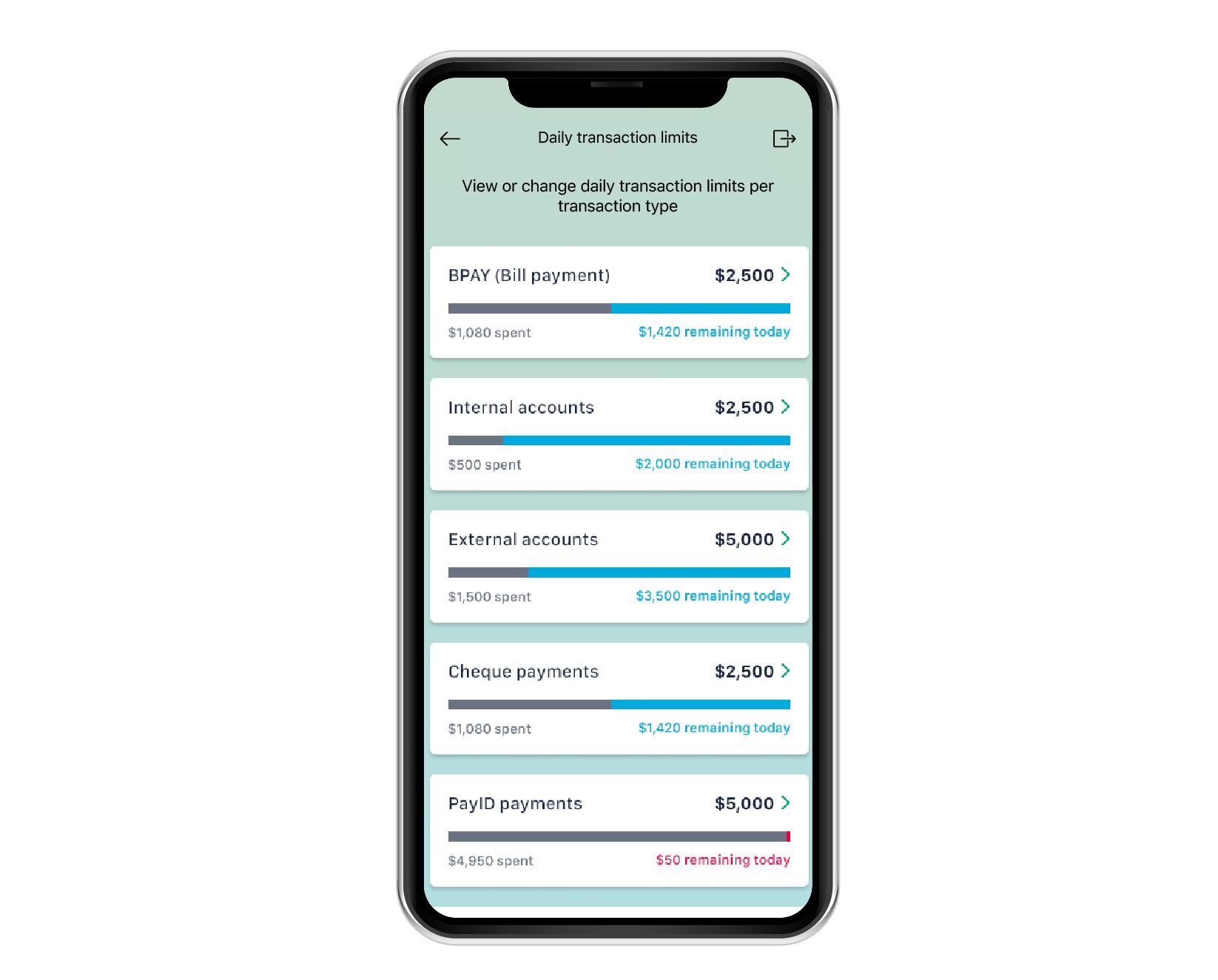

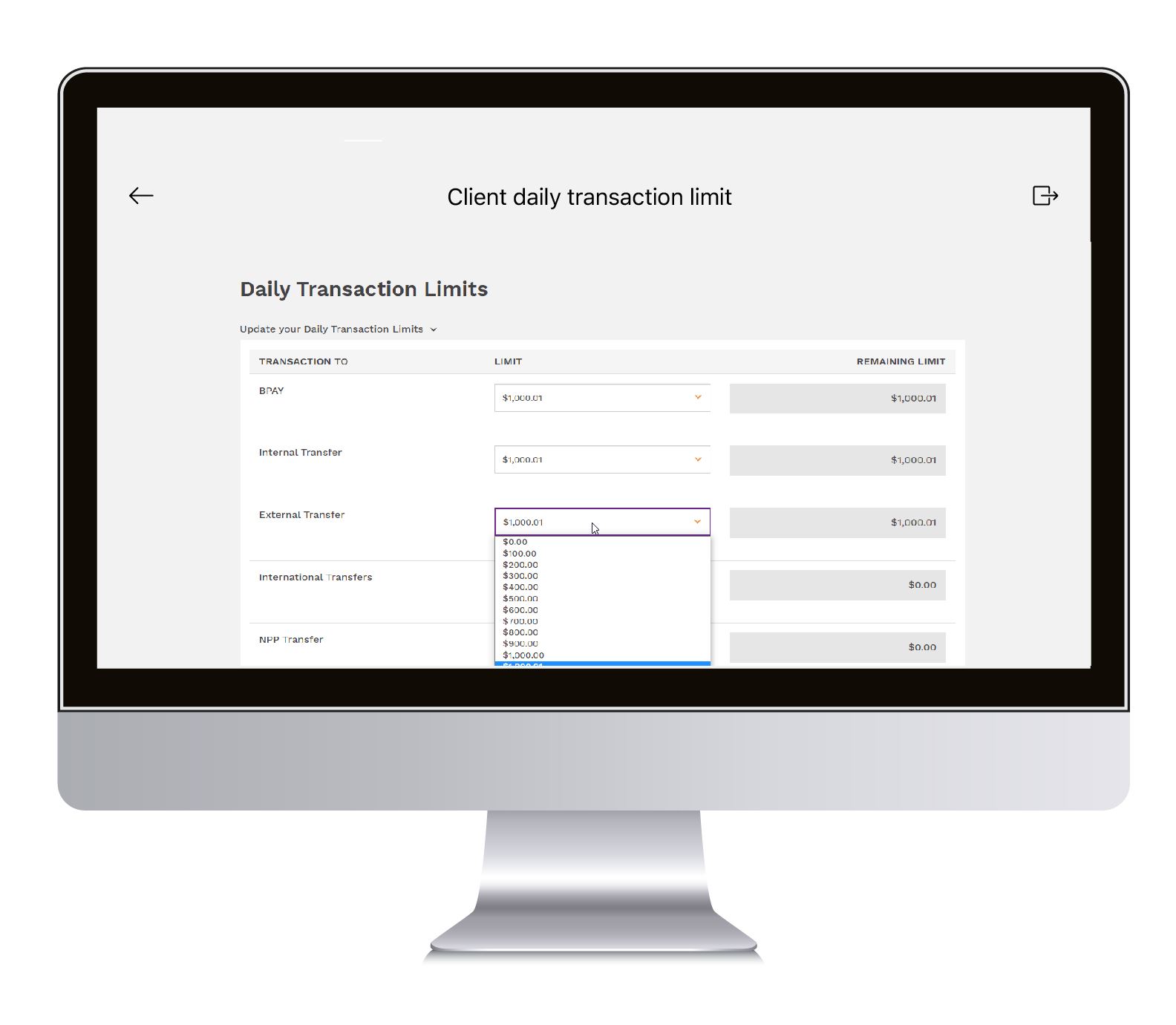

The new client daily limits module is a more powerful measure to reduce the costs of fraud and help ward off unwarranted risks by enabling limit setting by the organisation for the customer.

Client daily limits is bespoke and is not a ‘one size fits all’ solution.

Impose limits in Ultracs on the total value of transactions, based on transaction type, that a customer can perform in a day (resets at midnight) and;

Flexible parameters allow the setting of an endless variety of payment limits from a global level, down to temporary and bespoke options for specific personal and business customers including;

When the client daily limits functionality becomes active, all existing account daily limits are no longer applicable, with;

As an added security measure, and a further optional module, the ‘Client Daily Limits - Approvals’ can restrict the maximum amount that an operator may enter for a daily limit before requiring approval from a secondary operator for limits above the threshold for each payment type.

Exclusive to My Viewpoint 3 release 4 only is the ‘self-service’ at a ‘customer level’ activation option.

"Digital engagement serves as the key to optimising the consumer experience, with on-boarding and self-servicing as the key drivers"1

The 'Client daily transaction limits’ optional module which enables customers to self-service their own limits in real-time impact to suit their own banking management preferences is exclusive to My Viewpoint 3 release 4.

This exclusive optional module is dependent on the ‘Client daily limits’ optional module and Ultracs 5.1, and sees all customers operating in a cyber secure Ultracs Ecosystem environment.

Call us and ask our Client Engagement team for a detailed My Viewpoint 3 release 4 product brochure, and get set to position your organisation in delivering the next level of user experience in digital banking.